Summary: I argue that we’d be better off if we had more and more efficient price discrimination, and suggest a simple scheme the IRS could use to enable it. This probably isn’t a good idea. Also, I just learned that Buck proposed exactly the same thing 2 months ago, I guess something is in the air but I’m not sure what.

Suppose I’ve made a drug and am deciding at what price to sell it; or that I’m Adobe deciding what price to charge for Photoshop; or that I’ve built a private road and am deciding what toll to charge (when there is no congestion).

If it costs me $2 to make a pill, and someone isn’t willing to pay $2 (e.g. because they don’t want it at all), then I shouldn’t give them the pill. If they are willing to pay $2, then it would be socially efficient to give it to them, and the only question is what the price should be.

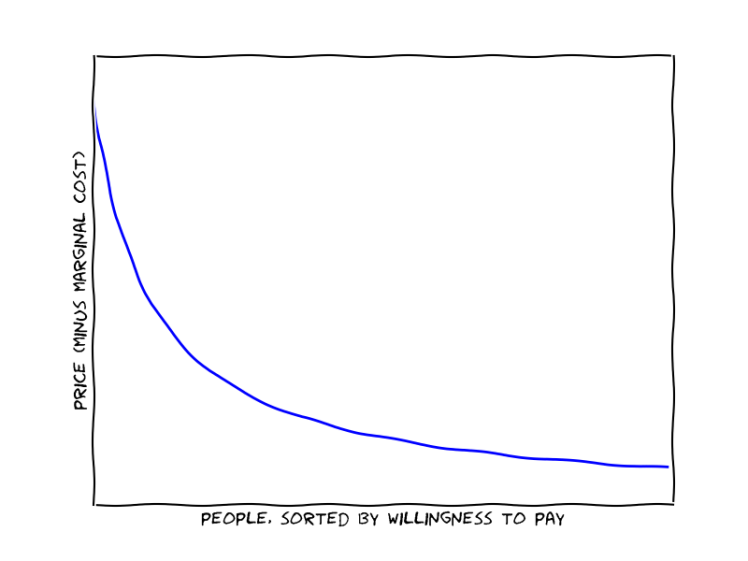

Different potential customers are willing to pay different amounts for my product. We might summarize the situation with a graph: on the x axis are people, on the y axis are prices, and the blue curve represents willingness to pay, the highest markup at which the customer would be willing to buy my product.

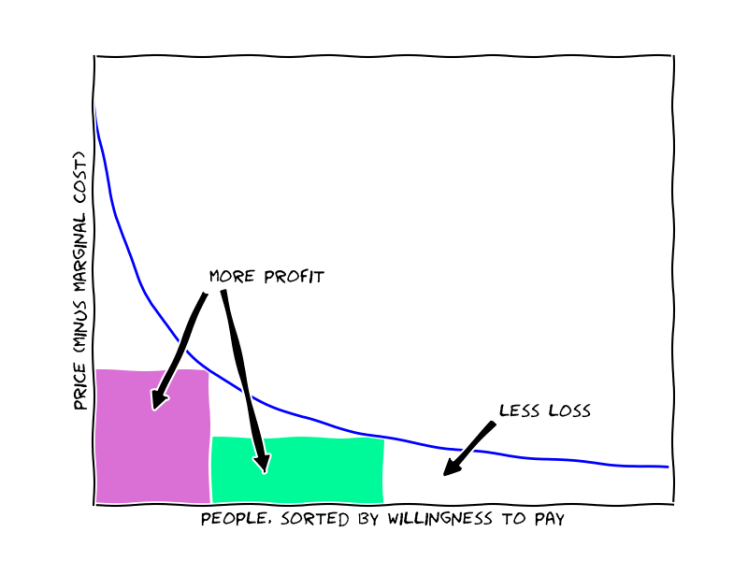

If I charge more money, I will get fewer customers but make more per customer. If I want to pick the single price that maximizes profit, I’m basically trying to inscribe the rectangle of maximal area under this graph:

Where the markup I’m charging is the height of the green rectangle.

There are two problems with this situation: first, a bunch of people aren’t getting the product even though it would be socially efficient (that’s the deadweight loss). From a distributional perspective this is especially annoying because those people will tend to have less money to start with. Second, I’m not getting paid enough for producing the product (that’s the consumer surplus), and so it will tend to get underproduced.

You may not be used to seeing the consumer surplus described as a “problem,” but that’s the kind of guy I am. (Also: this is the discussion for a single seller, if we step back to consider the entire market then the whole point is to generate surplus.)

Price discrimination

I would really like to charge higher prices to the people who are willing to pay a lot, and lower prices to the people who aren’t willing to pay a lot; this is called “price discrimination.” It potentially fixes the problem with some people not getting the product even though they should, and it also means that the compensation for making a product is closer to the social value it creates.

You can’t directly observe how much a customer is willing to pay, but you can try to effectively charge different prices for different groups anyway. For example:

- You could provide a crappier version of the product and offer it more cheaply. For example, you could sell books and movies more cheaply after they’d been on the market for a while, or take out some software features that are especially important to high-paying customers.

- You could make the cheap version of the product visually distinctive in the hopes that wealthier customers won’t want to send a bad signal by purchasing it.

- You can make the cheap version harder to purchase, for example by requiring it to be bought as part of a larger bundle (commuter transit passes), or by requiring it to be bought further in advance (plane tickets for vacations, in the bad old days), or by requiring the customer to spend some time to get it (clipping coupons, shopping around sales)

All of these measures potentially increase efficiency by facilitating price discrimination. They also directly lower efficiency, by placing artificial restrictions or imposing artificial costs on customers.

Some forms of price discrimination mostly avoid these negative effects: if we can predict that students or children or families or seniors are willing to pay less, then we can just directly offer them a lower price. This is an especially great form of price discrimination.

The proposal

A wide variety of factors determine someone’s willingness to pay for a product. But one extremely important and nearly universal factor is how much money they have. One of the purest forms of price discrimination is to charge a lower price to poorer customers.

Wealth-based price discrimination is often implemented by making discounts available to customers who pay non-monetary costs that wealthy people wouldn’t pay (since they don’t care as much about the discount). These measures don’t seem super effective, and as an added drawback they impose random and socially unnecessary costs on low-income families.

As it turns out, the government already monitors how much money everyone makes. So here’s a possibly-more-efficient alternative:

- When you pay income taxes, the IRS notes your income. At any time you can go to an IRS website, verify your identity and specify an amount $X, and then immediately receive a verifiable digital certificate saying “Your income last year was less than $X.” If you wanted to, you could show this certificate to anyone. You could potentially also get certificates establishing bounds on household income per adult, capital gains, average income over the last decade, and so on. You cannot use this system to provide any verifiable lower bounds on income, only upper bounds.

- Some goods or services could be sold at different prices based on the customer’s income. This is precisely analogous to claiming a student discount or redeeming a coupon. Ideally it would be pushed as late as possible in the purchase process and be as discrete as possible.

- Prices might adjust continuously based on the purchaser’s income, or there could just be one or two discounts based on thresholds. For example, a web service subscription could cost 1/1,000 of your income; or a service might usually cost $10/month but be reduced to $4/month if you make less than $40,000/year.

I expect this proposal to seem objectionable to lots of people, but as far as I can tell it would significantly increase efficiency and have positive distributional effects–at least if we ignore the costs of implementing it.

Distributional effects etc.

This proposal would reduce prices for poor consumers and increase prices for rich consumers. As a society we already pay costs to take money from rich consumers and give it to poor consumers, so we should be happy to get some extra redistribution in for free. Moreover, this proposal doesn’t involve any expansion of the government, is economically efficient, and is good for business, so this should be an unusually palatable form of redistribution to people on the right.

If adopted widely, it would also increase the effective marginal tax rate on everyone (since earning more money forces you to pay higher prices). But as far as I can tell, this is an unavoidable artifact of any form of redistribution, so this scheme isn’t making the negative incentives per unit of redistribution any worse.

In aggregate this scheme transfers value from consumers to producers. For the most part I think that’s not a big deal–most of the benefits eventually flow back to consumers in the form of wages, returns on capital, and more goods being produced. It does potentially have upwards-redistributive effects, if high-income workers and capital-holders are involved in more production relative to consumption. But these effects seem to be more-than-cancelled out by increased prices for high-income workers and capital-holders.

Some logistics

The actual implementation would probably not be by showing certificates to sellers. I imagine that people like credit card providers or PayPal would offer special accounts; they would check your income, and then would certify it to sellers during the payment processes. Or you might use a certificate to prove eligibility for a special Amazon account. Or discounts would be claimed as rebates. I’m not sure. This could all be built by the private sector after the fact.

Sellers would hopefully not be involved in directly setting prices. Instead this information could be used by services like Freshplum, who are essentially charged with setting prices in order to maximize income, using whatever information they can find. Ideally, from the seller’s perspective this would be integrated with their payment processing infrastructure, and would only require specifying a small amount of additional data (e.g. a “basic” price that they would have charged absent price discrimination, perhaps a marginal cost, and a few other details). This would also be built by the private sector.

Last-year’s income is not a great proxy for being cash-strapped, which is what we really want to estimate. I’m not sure how great a proxy you can actually construct using tax info. It seems like you can probably make a pretty good one by using a few years of income, looking at capital gains, and considering dependency status. Ideally the authorities would offer a wide range of possible certifications, and the market would decide which combinations were most useful for price discrimination. The incentives of the sellers and middlefolk seem to be basically aligned with social welfare, though I might be overlooking a bunch of details.

All of those services might take time to built up, and they might never be built at all. But if it takes a while or never gets done, it’s not a really big deal.

The IRS’ role in the proposal would hopefully be offensively simple. A minimal implementation might be: you can receive a special code by the same channel that you receive your tax refunds. By providing this code + your SSN/TIN at a government portal, you can make requests for verifiable certificates. These certificates are signed by the government, and specify your identifying information (or whatever subset you request) along with the requested claims about your income, dependency status, etc.

The entire thing could be much easier if all of the data about income was simply published where anyone could see it, and sellers could use it to set prices without any coordination with buyers. I have a feeling that would be a deeply and inherently problematic proposal though. (And that the mere problem of people losing their codes due to phishing attacks will already be enough to scare everyone away.)

The stakes

(Warning: these numbers are pretty made up. Please feel free to criticize them.)

I don’t know how much value is actually on the table here. In principle the total value to be gained from perfect price discrimination is basically the same as the value to be gained from this proposal. I might eyeball the total deadweight loss (in America) at ~$1T/year, or $3,000 per consumer, though it could easily be much higher or lower.

I expect that having perfect access to people’s income would allow you to capture a modest but non-negligible share of that total value, perhaps 10% at the outside. Government certificates of income would allow you to capture a modest but non-negligible share of that, perhaps 30-50%, even in the case where everything went incredibly well. And there are a bunch of frictions and annoyances that would claw back costs. So overall I’d be very surprised if you could capture more than perhaps 1-4% of the total value being currently left on the table. Even 1% would be a big success.

If the total value per consumer is $30/year, that’s basically not enough to justify forcing people to have to think about one extra thing. I could be really underestimating the total value on the table. Really I would need to have way more insight into the actual situation of low-income consumers in order to really estimate the value up for grabs, this kind of Fermi estimate is totally irresponsible. Given how messy life is, it seems more likely that I’m overestimating the goodness than that I’m underestimating it.

To be clear, I still think this is relatively robust and is overall more promising than most of the wacky institutions proposed on the internet. It’s just not something that should be seriously compared to e.g. raising tolls on the bay bridge, which I think would probably make the world substantially better.

Conclusion

I think it would be nice if the world had more price discrimination; we would produce more goods, and those goods would be available to more people. As a society we could enable price discrimination by providing more high-quality signals to be used by price discriminators. The IRS is in a particularly attractive position to offer such signals since income is a particularly useful signal. But realistically I think that such a proposal would require coordination in order to get consumers’ consent to make the data available (and to ensure that only upper bounds were available); the total gains are probably not large enough to justify the amount of coordination and complexity that is required.

You say this mightn’t be worth it given that it is an extra thing to think about. However if it replaced thinking about coupons and standing in lines and whether your intentionally second-rate looking items make you look bad, perhaps that would be worth something.

I think my intuitive model is treating intentional changes to the status quo as a cost, and weighing it against the gains that can be achieved by other comparably-significant kinds of change.

I proposed this in a contest just over a decade ago. I no longer think that increases in profits should be expected to flow back to consumers to a very substantial extent. In a much much better world though, this would work.

Suppose with some effort everyone could be assigned a very accurate WTP score for a variety of products (using tax data, google search history, social circle data etc; and some technological and regulatory means that prevent falsification of data), and products would be priced accordingly: Photoshop cheaper if you’re not that much into digital image editing, visit to the museum expensive as soon as you discover your inner arts lover.

I have the impression that it would make many people poorer (since things get more expensive for them), leave many people indifferent (since prices get lowered for them, but only to a point where they are just worth the effort of buying — really these people only profit as much as their WTP is underestimated), and be beneficial mainly to people who make their living from stock dividends.

I guess it would also incentivize people to write software / provide services that would not have been profitable without price discrimination; but again, people have to pay so much for it that they almost don’t care about these options.

In general about 1/3 of income goes to capital-holders and 2/3 to workers (not to mention tax revenue, which hopefully benefits everyone). So it seems like roughly 2/3 of the excess profits overall probably go to workers? I grant that these might be disproportionately high-skill workers, but I’m not sure.

In even mildly competitive markets, still some surplus goes to the consumers—if both A and B make substitute TV shows, and I buy A’s show and pay my entire WTP, I am still getting surplus relative to the world where neither A nor B made a product.

If we imagine “local monopolies” as a thing that people are producing (e.g. I make a show so I can have a monopoly on selling it, I make a bridge so I can have a monopoly on tolling it…), then it seems like on average all of the monopolies make return on capital equal to the marginal return on capital from a monopoly (since if a type of monopoly had higher expected profits than this, then someone would make a closer substitute, driving down the returns in that area), and I think the rest gets paid out as consumer surplus? Obviously the situation is super complicated, but that seems like the closest approximation.

Isn’t “profit” the money that goes to the capital holder, while the money that goes to workers is part of the fixed and marginal cost of setting up a monopoly and producing units? On the other hand, with price discrimination available, more “expensive” products (with the higher cost going in part to workers ) could be produced, so I guess you are right here.

(Side thought: The products that you are able to create once you can price discriminate might be more resource intensive instead of labor intensive. You would end up burning oil / using up land without making any one much happier by doing it, as everyone ends up paying almost as much for it as for their next best alternative. I think this goes beyond what you could fix with e.g. a carbon tax, since the land / energy you are using will end up raising the price of these resources for everyone else.)

The local monopolies idea is interesting — since price discrimination makes it more profitable to create products, this leads to competition and hence consumer surplus eventually. Though I am not yet convinced if this, from the consumer’s perspective, offsets the higher cost from price discrimination. To me it seems like this might go one way or the other depending on the type of product / cluster of monopolies / game theoretical setup.

You would have to make the system compulsory. Otherwise rich people would get poor people to buy the goods for them. For example, suppose there is an item that Mr. Rich pays $10 for and Mr. Poor pays $1. Then, Mr. Rich would get Mr. Poor to buy it for $1 and then sell it to him for $2 (or some other price between 1 and 10).

I agree that this only works for goods which are hard-to-transfer (like many other forms of price discrimination).

Hm, it seems there are two aspects of consumer surplus: the hidden knowledge that individual consumers have about their own realized surplus from a transaction, and the general willingness of people with greater wealth / income to pay more. In aggregate, the latter aspect would be easily captured by a progressive consumption tax (tax on annual income minus annual saving) with the consumer surplus going to the government. This sounds bad, but it isn’t so bad if the progressive consumption tax can be used to reduce other taxes that already discourage investment. The former aspect (hidden knowledge) is trickier, but it seems safe to say that companies are working hard at mining social media data to create targeted offers and extract whatever consumer surplus they can. Also, in practice, I think companies are already quite good at creating differentiated products with variable price points that appeal to different quantiles of the income distribution. This probably reduces the aggregate deadweight loss, and also reduces the potential benefit of policies that would encourage further price discrimination.